Welcome to 2024

What could possibly be ironic about interest rates and the 2024 San Carlos real estate market? Hang tight. We’ll get there. First, some background:

I dubbed the 2022 San Carlos real estate market, The Market of A Lifetime, and it was the featured article in that year’s San Carlos Real Estate Report. The perfect storm of rock bottom interest rates, a buyer appetite for single-family homes that was unmatched as we came through the pandemic and numerous government incentives to keep homeownership aggressively moving forward. The fourth quarter of 2022 saw a decline, but it was not enough to take away from the totality of the Market of a Lifetime. There was a period of time between March and April of 2022 where some single-family homes in San Carlos were appreciating at a rate of $100,000 per week. Yes, you read that correctly. Then interest rates started to tick up and while the market did not come crashing down, the impact was felt.

From the peak of the 2022 market through 2023, interest rates climbed 3.0 percentage points. While 3 percentage points may not seem like a big deal, consider the following scenario for your average San Carlos purchase:

A 2022 purchase of a $2,500,000 home at 4.5% with 20% down equates to a loan payment of $10,134 per month.

Now, consider that same home being purchased in 2023 with a 7.5% interest rate. Assuming a 20% down payment, the 80% loan payment is $13,984. A nearly, $4,000 difference per month, or net $48,000 per year more expensive.

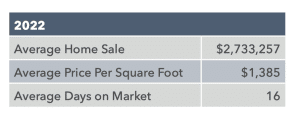

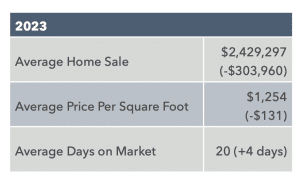

So, just how much of an impact did the interest rates have on our market? Here are the numbers:

The net effect of the interest rate hike has caused the average home in San Carlos to lose approximately $300,000 off their 2022 highs. While this is certainly a lot of money, also understand that it is coming off highs that were beyond extreme in March and April of 2022, when some homes were gaining $100,000 per week. All in all, San Carlos has held up remarkably well and the confusion of 2023 is likely ready to give way to stability in 2024.

The Market’s Secret Weapon

At this point you may be approaching “2024 stability” with a tremendous amount of skepticism, which I understand. However, did I mention the irony with interest rates?

Just how low were the interest rates in 2021 and 2022? Lower than they have been in the last 55 years. If history is any indication, we will not see rates back

in the 3% range in our lifetime. These rock bottom interest rates were the primary accelerant for an out-of-control seller’s market in 2021 and 2022.

Now that they have normalized, currently at 6.90% (the 30-year average is 7.75%), one would expect the market to take a hit. It did. From the figures above you can see the market took roughly a 12% hit in home values between 2022 and 2023. Many buyers are hoping for another significant drop in 2024. Absent something terrible happening to the national and local economy, I believe those buyers may be holding onto false hope. The reason, the irony: interest rates.

Buyers are relying on higher interest rates to bring down values. The reality is that they have already brought them down 12%. The irony is that they will stabilize them in 2024. Here’s why:

Each year the number of available listings in San Carlos pulls from three primary buckets:

- The Move Up Buyer: A buyer sells their current San Carlos home and buys a larger home or downsizes to a smaller home.

- Estate Sales: A seller passes away and the estate sells the home.

- Relocation: A seller moves out of the area to relocate for a job and the home is sold as part of that transition.

Two of the three categories above will be greatly diminished in 2024, likely reducing inventory levels to the lowest numbers we have seen in decades. The Move Up Buyer will not be completely erased from the scene, but the vast majority in this category will choose to remodel or stay in their current home which has a 3%, 30-year fixed mortgage, rather than opt for a larger home at a 7.5% interest rate. The prospective difference in payments is substantial. Additionally, the odds of current San Carlos homeowners being wooed by relocation offers with many tech companies across the United States will be diminished due to hiring freezes. The relocation bucket detailed above will be less plentiful than in years past. The loss of prospective listings coming from these two primary buckets will keep inventory at extremely low levels, and perhaps the lowest level in 30 years.

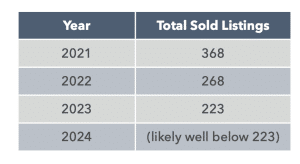

The projected trend for 2024 already made itself known in 2023. Consider the difference in sold listings in San Carlos in 2021, 2022 and 2023. Keep in mind that interest rates started to increase noticeably around the middle of 2022 and the total listings available started to slow almost immediately. 2023 continued this trend as the rates started to rise further.

Lifetime-low interest rates were primarily responsible for the run-up in prices in 2021 and 2022. Now, that they are normalized, they will ironically keep working as the main counterweight against a buyers’ market by sharply limiting available inventory. It will be the story in San Carlos real estate in 2024.

Leave A Reply